Mass Timber Performance Index (2025)

Roy Anderson

Vice President, The Beck Group

Erica Spiritos

Growing regional mass timber ecosystems

INTRODUCTION

The Mass Timber Performance Index serves two purposes. First, it estimates North American Cross-Laminated Timber (CLT) market prices. Unlike commodity lumber, CLT pricing is project- specific and is influenced by its own set of supply and demand factors. It is helpful to think of CLT as a custom building component rather than a commodity product. Second, the index describes the North American mass timber industry’s scope in terms of number of buildings constructed, the corresponding volume of lumber consumed, and the utilization of existing CLT manufacturing capacity.

CLT PRICE INDEX

Putting a firm number to CLT market prices is a tall task. Accurate market price reporting is challenged by the relatively small number of producers, the lack of publicly available data on market pricing, and the custom-made nature of CLT production. Accordingly, the CLT price index provides a likely pricing range. Actual CLT panel market prices will reflect project-specific factors such as market conditions, a manufacturer’s efficiency, and how strongly a manufacturer desires to win the work.

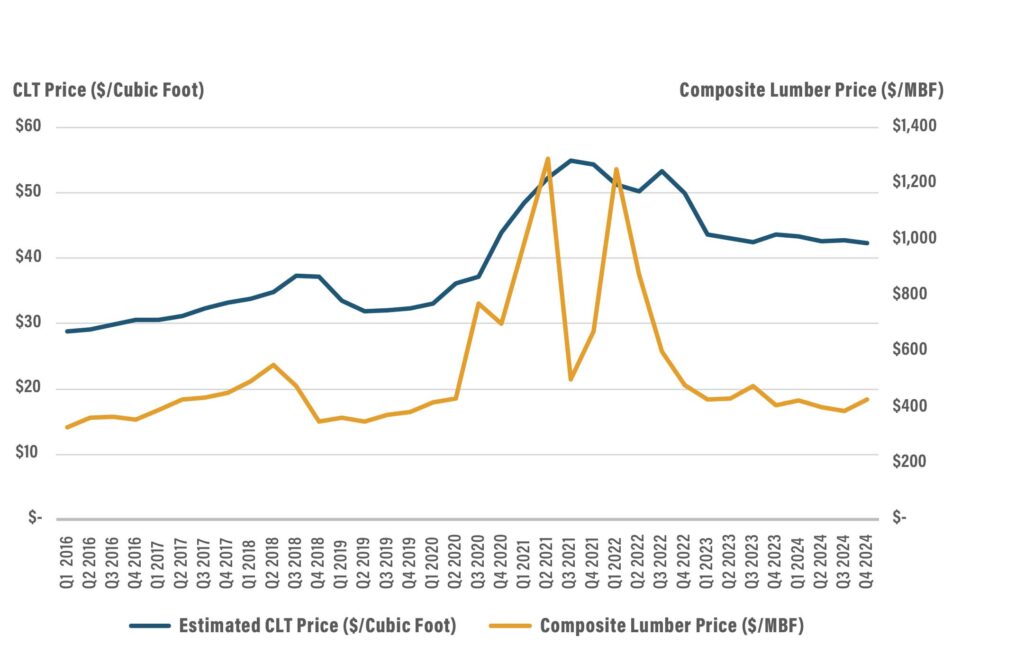

In Figure 1, we update the CLT price information with data for the period Q1 2016 to Q4 2024 (the blue line with units that correspond to the left axis). This information first appeared in the 2022 edition of the International Mass Timber Report. Prices have held fairly steady during the last 2 years at around $42 to $44 dollars per cubic foot. The CLT market prices shown here are derived from a financial model of a prototypical CLT manufacturing plant. The estimated CLT panel prices in the figure include estimates of the cost of producing CLT and a margin for the manufacturer’s profit. In 2024, the model was refined to include a more accurate representation of administrative overhead costs; escalation and inflation for all labor and materials dating back to 2016; and 3D modeling and Computer Numerical Control (CNC) fabrication costs to transform billets into custom components. Excluded from the market price estimate is the cost to transport the finished product to customers.

Also shown in the figure (the orange line with units that correspond to the right axis) is an estimated market price for lumber, derived from Random Lengths, a lumber price reporting service. Lumber pricing is discussed in greater detail in the next section.

FIGURE 1: CLT PRODUCT PRICE INDEX

LUMBER PRICE DISCUSSION

The composite lumber price (an average of more than 20 different lumber grades and species) in Q4 2024 is almost identical to the price in Q1 2023. There were a few modest peaks and valleys, but for the past two years, lumber prices in North America have been more stable than at any time since 2016. This stability provides some predictability to mass timber manufacturers and has dissipated the pandemic-era phenomenon of having higher-priced lumber inventory sitting in the yard waiting for manufacture. According to our financial model, the cost of purchasing lumber has been holding steady at around 40 percent of the total cost of manufacturing mass timber panels.

In early 2025, many economists are pointing to positive signs in the economy, which typically translate into rising wages, job growth, lower interest rates, and a higher rate of housing starts. All these factors increase lumber demand and strengthen prices. However, early 2025 is also a time of major uncertainty in lumber markets as it is unclear whether President Trump will impose a 25 percent tariff on all goods imported from Canada, including lumber. It is our belief that any tariffs that are implemented will quickly be resolved because they would have severe negative economic impacts for both countries.

Regardless of tariffs, the potential for a spike in lumber prices remains as a result of the log supply shortage described in last year’s report. British Columbia, Oregon, and Washington have all enacted policies that constrain harvesting on public and private lands. Additionally, wildfires limit the ability to harvest trees during significant portions of the year. Fires also have the longer-term impact of reducing the standing inventory of timber available for harvest. The constrained ability to harvest timber translates into reduced lumber production. If lumber demand increases in 2025, the ability to turn on the spigot is hampered by raw material supply. Exacerbating this situation is the recent closure of a number of sawmills in the Pacific Northwest and British Columbia.

OTHER FACTORS AFFECTING CLT PRICE

Although lumber is the primary driver, several other factors contribute to the overall CLT market price. Below, we outline these factors to help project teams understand the impacts of their design decisions and other supply-chain factors outside of their control.

- Panel thickness: Though panel pricing is often given on a volumetric basis, the price of a 5-ply might not be the same as the price of a 3-ply. The height of a press bed will govern how many panels of each thickness can be produced per press cycle, resulting in different pricing for panels of different thicknesses.

- Strength grade: Electronically rated (made from Machine Stress Rated [MSR] lumber) panels will be more expensive than visually graded (V-series) panels because they are manufactured with stronger and stiffer lumber that is more costly than visually graded lumber.

- Species: CLT is manufactured from a variety of tree species including Douglas-fir; Southern Yellow Pine (SYP); and spruce, pine, fir (SPF). Each species has its own supply and demand landscape that affects its market pricing.

- Visual Quality: Architectural or visual-grade CLT is more expensive to produce, given the added cost of sanding the exposed surface(s).

- Billet utilization (waste): Billet utilization will fluctuate depending on the geometry of a mass timber building and the efficiency of the panel layout. Waste material is generated as CLT panels are transformed (via CNC machine) from rectangular billets into custom components. Manufacturers will include the cost of unused waste material in their pricing.

- Project complexity: CLT manufacturers do not estimate the cost of individual CLT panels. Rather, they estimate the cost of delivering a specific building project. Design assist and 3D modeling (detailing) costs rise as project complexity increases. Thus, buildings with complex designs are more expensive to produce.

GLULAM PRICE DISCUSSION

Let it be known that the price of CLT does not equal or correspond to the price of glulam on a volumetric basis! Glulam is manufactured from a special grade of lumber called lamstock, which is of higher quality than the #2 & Better and #3 & Better grades typically used to manufacture CLT. For example, the edges of all boards in a glulam beam are visible. This means that lamstock must be perfectly square (with no wane). This more restrictive specification reduces the available lamstock supply. Additionally, lamstock’s maximum allowed moisture content is 15 percent(12% +/- 3%). That requirement drastically reduces the number of sawmills from which glulam manufacturers can source material because kiln capacity is often the limiting factor on production at sawmills. Also, drying to a lower moisture content often lowers the grade yield. The result is lamstock pricing that may be more than double that of lumber used to make CLT. And the story does not end there.

The width of a glulam beam and the corresponding width of the lamstock further impacts pricing. Wide boards (2×10, 2×12, 2×14) that meet the quality requirements are more limited in their availability. The result is significantly higher pricing compared to more readily available lamstock widths (2×4, 2×6, 2×8). The price of 2×12 lamstock, for example, could be $1400 per MBF, while 2×4 lamstock sells for $800 per MBF. Recall from Figure 1 that the composite softwood lumber price in 2024 was only about $410 per MBF.

Wide beams, and therefore wide boards, are increasingly common in mass timber construction— particularly in fire-rated buildings where the structure is designed with a sacrificial char layer of approximately 1.6 inches per hour on all exposed sides. This means that the average beam in a mass timber building may be 10.75 inches wide, produced from all 2×12 lamstock.

Although there is currently no publicly reported price index for lamstock or glulam, some price indicators exist. For SYP, one can look at the lumber price in Random Lengths for #1 Southern Pine, Kiln-Dried, East Region, and then assume further cost for additional planing and drying. For Douglas-fir, one can look at Random Lengths price for Structural Light Framing for Fir & Larch from Spokane, Grade 2400f as an indicator for lamstock pricing. Unfortunately, Random Lengths publishes prices only for standard board sizes. Assume wide boards are 1.5 to 2 times the published price.

Lastly, it is helpful to understand that there is no standardized approach to pricing glulam. Some manufacturers will price glulam based on an average cost of their lamstock inventory, while others will price the lamstock required for a specific order (project). We hope that this narrative sheds some light on the dynamics affecting glulam pricing and look forward to being able to provide corresponding data as the number of suppliers grows.

MASS TIMBER DEMAND

In 2024, the demand for mass timber decreased in line with the overall construction industry, as high interest rates made it challenging for developers to secure affordable funding. According to WoodWorks data, roughly 155 mass timber projects either began construction or were built in 2024, a 20 percent reduction from the 197 projects in 2023. Another 1,168 projects are in the design stage in the US as of December 2024, indicating that there is strong demand for mass timber construction once funding becomes more available and affordable.

As the demand for mass timber grows, keeping track of completed projects becomes more challenging. For this reason, we ask our readers to review the WoodWorks Innovation Network (WIN) database—the best source of industry information on the demand for mass timber in North America—and ensure that all their mass timber projects are listed.

Notably, the WIN database tells us that the demand for mass timber is not equal across the continent, and that certain states are far outpacing others in the use of mass timber to construct future skylines. This year, California, Texas, Washington, Massachusetts, Georgia, Colorado, and New York all have more than 50 new mass timber projects in design and construction. Assembly, business, educational, and multifamily buildings were the leading market sectors, accounting for over 80 percent of new mass timber construction in 2024.

WoodWorks/Wood Products Council provides free project support to the Architecture, Engineering, Construction and Design (AEC+D) community on multifamily, institutional, and commercial buildings. Growing the mass timber market is the objective of the organization, and it has been a driver of the market since mass timber began in the US. Feel free to reach out to them for any assistance. Readers can also find the latest data and trends at woodworks.org. They can see details about most of the projects at woodworksinnovationnetwork.org.

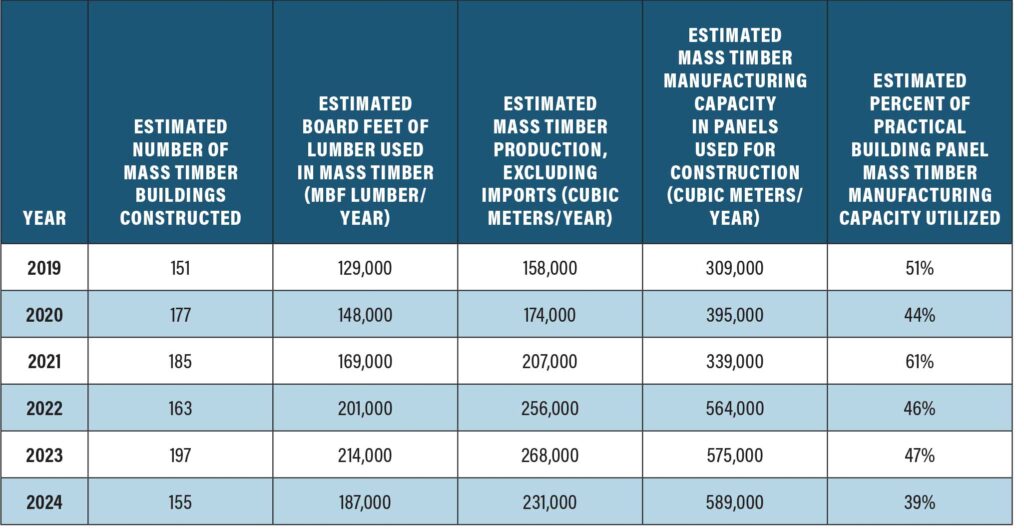

TABLE 1: ESTIMATED MASS TIMBER LUMBER USAGE AND PRODUCTION IN THE US AND CANADA (2019 TO 2024)

MBF = 1,000 board feet

STATE OF THE INDUSTRY IN NORTH AMERICA

Though 2024 was a slow year for the construction industry as a whole, with a reduced number of mass timber projects relative to 2023, we witnessed the mass timber industry take strides toward increased capacity in preparation for anticipated increased demand.

SmartLam opened a state-of-the-art glulam manufacturing facility in Dothan, Alabama, in a brandnew building adjacent to its CLT manufacturing facility. The $50 million glulam manufacturing facility, equipped with machinery from Ledinek, can produce as much as 84,000,000 board feet annually of large glulam beams and columns required to properly serve the mass timber market. Previously, glulam and CLT production had been housed under one roof in Dothan. Dothan is strategically located to serve the Southeast, one of the fastest-growing mass timber markets in the United States. SmartLam North America has 1.5 billion board feet of available SYP lumber annually between its 4 southern sawmill shareholders.

SmartLam North America also spent an additional $24 million to fully automate the existing CLT facilities in Dothan and Columbia Falls, Montana. This additional investment will allow each facility to produce 2,000,000 cubic feet (more than 55,000 cubic meters) annually.

On the west coast, Timberlab took major strides toward becoming a manufacturer when it acquired American Laminators’ glulam production facilities in Swisshome, Oregon, and Drain, Oregon. The Swisshome and Drain locations have been operating for over 60 years, utilizing Douglas-fir, SYP, and Alaskan Yellow Cedar, accounting for an annual capacity of 20 million board feet. Each facility will undergo operational upgrades to continue enhancing product optimization and continuing the legacy of manufacturing in the 2 communities.

Timberlab’s acquisition of American Laminators followed soon after the announcement that the company would construct and operate a state-ofthe- art CLT manufacturing facility in Oregon’s mid-Willamette region. The facility broke ground in Millersburg, Oregon, in February 2025 and is expected to commence operation in 2027.

LUMBER USAGE

In this report, we used a different data source for the number of mass timber buildings constructed in Canada: the Interactive State of Mass Timber in Canada Dashboard, produced by Natural Resources Canada. Thus, the lumber usage and capacity utilization figures have changed from what was reported in prior years. The new data has fewer buildings constructed than what we previously estimated. This means that the estimated total annual lumber usage in the mass timber market has dropped slightly. As Table 1 indicates, it is estimated that lumber usage peaked in 2023 at 214 million board feet. In 2024, lumber usage in the mass timber sector is estimated at 187 million board feet. That usage volume is roughly equivalent to the total annual output of a single modern, large-scale softwood sawmill.

Aside from the update in source data for the number of buildings, the reduced lumber consumption is a result of the year-over-year drop in the number of mass timber buildings completed in North America, declining from the peak of 197 in 2023 to 155 in 2024. All other things being equal, it is estimated that the number of buildings completed per year would need to grow to about 900 for annual lumber consumption to reach 1 billion board feet consumed in mass timber construction. As a point of reference, North America has consumed nearly 60 billion board feet of lumber annually for the last several years.

For sawmills interested in the emerging mass timber market, one opportunity is to produce lumber of nonstandard thicknesses to enable the manufacture of thinner and more efficient panels. The availability of thinner lumber provides greater flexibility in panel design and allows for more efficient use of fiber in applications where a thinner 3-layer panel is adequate, such as in the sizable residential housing market. The use of 10-millimeter and 20-millimeter-thick lumber is a hallmark of European CLT and makes it challenging for North American manufacturers to compete on projects. Currently, sawmills face challenges in producing thinner lumber, as smaller piece size reduces productivity and increases cost. Also, when dimension lumber is tallied, it is counted as being 2 inches thick, even though the actual thickness is only 1.5 inches. The difference between nominal size and actual size, on a percentage basis, is smaller when lumber is sawed to a 1-inch thickness. This means the sawmill does not realize as much of a tally advantage when producing 1-inch lumber. Despite these challenges, efforts are underway to identify a solution for making a wider range of thicknesses available to the mass timber industry.

MANUFACTURING CAPACITY

This year’s analysis of mass timber panel manufacturing capacity shows a slight increase from 2023 to 2024, as we’ve added SilvaSpan in New Lowell, Ontario, to the tabulation. Although the data used to calculate the capacities shown in Table 1 is representative only of manufacturers that produce some form of mass timber panel, roughly one-third of mass timber is glulam, and glulam-only producers are not represented in the capacity calculations. In the future, this report hopes to secure more complete information on the glulam manufacturing capacity in the market, as there is a growing concern around the availability of glulam billets, and glulam fabrication continues to be a pinch point impacting manufacturers’ ability to deliver mass timber projects. Another factor that affects estimates of structural CLT production capacity is that some panel manufacturers are also producing panels for industrial applications (ground mats for temporary roading). At this time, informed assumptions have been made regarding the relative production of CLT for structural and industrial applications.

CONCLUSION

Often, when the market is at a low point in the cycle, it can be beneficial to undertake transformational steps to prepare for the future. Though demand was significantly lower in 2024 than in 2023, the mass timber industry hunkered down to get ready for the floodgates to open in the future. We hope that the commercial real estate industry will recognize and appreciate the efforts to increase capacity, answering a concern the industry has long had about material availability and procurement risk. As panel manufacturers are operating at less than 40 percent of their capacity, there is room for major players in both the public and private sector to integrate mass timber into future plans.

Download PDF

View the Agenda

View the Agenda

Book a Building Tour

Book a Building Tour

Book Your Exhibit Space

Book Your Exhibit Space

Explore the Exhibit Hall

Explore the Exhibit Hall

Become a Sponsor

Become a Sponsor

View Sponsors & Partners

View Sponsors & Partners

Reserve Hotel Rooms

Reserve Hotel Rooms

Discounted Plane Tickets

Discounted Plane Tickets

Read Case Studies

Read Case Studies

Download Past Reports

Download Past Reports