Everything but the Shade (2025)

Emily Dawson, AIA

Owner, Single Widget | Field Edge

I’M NOT ALONE IN HAVING MADE DUBIOUS social media-driven purchases. A tree-free toilet paper subscription seemed like a great idea during the pandemic. But researching this article put that small choice in a different light. The foresters I spoke with all had the same thing to say: markets for low-grade fiber (which can go into making paper products, for example) create the opportunity to practice better forestry. Without these markets, foresters lose a crucial tool. Just as chefs aim to “use the whole cow” to minimize waste, the forest products industry strives to use every part of a tree.

USING THE WHOLE COW

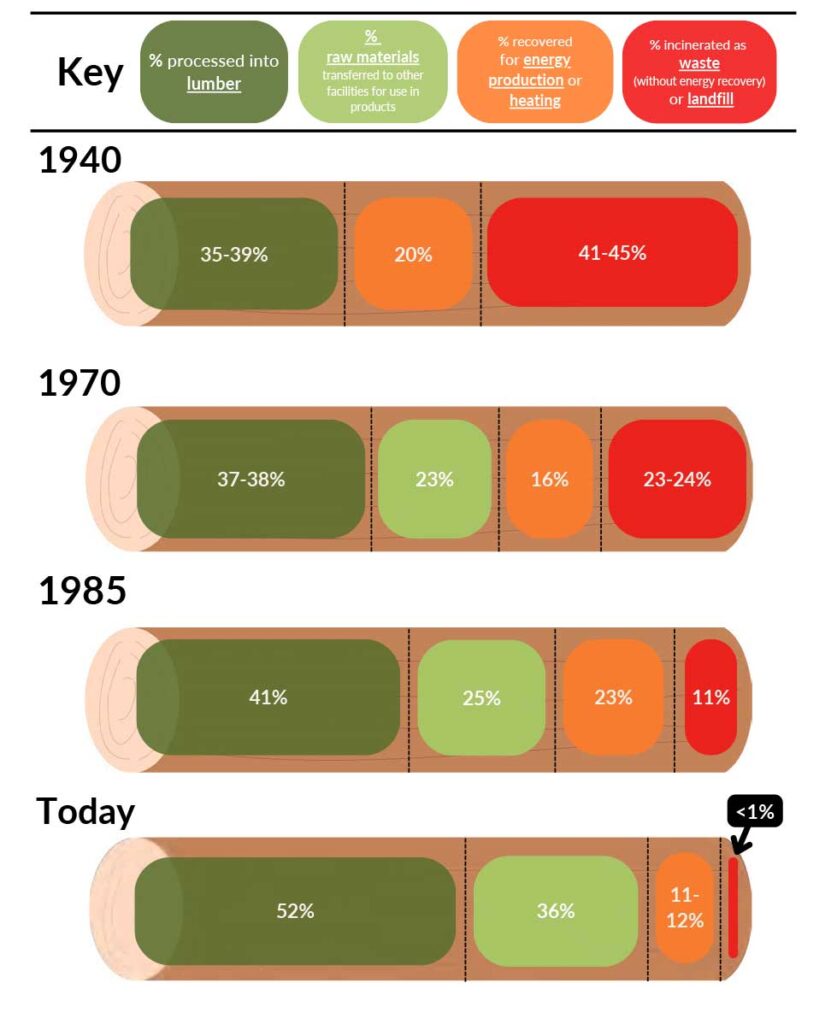

It turns out that it is easy to find uses for every part of the “cow,” but harder to find customers for some of the parts. A 2012 report by Dovetail Partners Inc. notes that, in North American forestry,1 “waste” is largely obsolete, with just 0.14 percent to 1.5 percent of harvested wood incinerated or landfilled (see Figure 1). Over the past century, a steady procession of technological advances turned previously discarded fiber into valuable products. A partial list includes particle board, structural I-beams, Laminated Veneer Lumber (LVL), medium-density fiberboard (MDF), Oriented Strand Board (OSB), Parallel Strand Lumber (PSL), wood fiber insulation, and biomass energy. Innovations in post-WWII engineered wood products (EWPs) directly enabled foresters foresters to harvest more material—not just the best, straightest, most lumber-ready trees.

FIGURE 1: UTILIZATION OF HARVESTED WOOD BY THE NORTH

AMERICAN FOREST PRODUCTS INDUSTRY, 1940–TODAY

Source: Dovetail Partners Inc., 2024

New Hampshire State Forester Andy Fast explains, “Without those markets, we’re limited to cutting only high-value trees, a poor forestry practice.” Vermont forester and author Ethan Tapper says having commercial outlets is crucial to forest ecology, in that it “allows us to totally explode our capacity to do restoration work.”2 Thinning small, less valuable trees is important for restoration projects and working forests alike. Thinning is necessary to sustainably produce higher-value fiber, and it’s crucial for creating healthy forest ecosystems that are resilient to fire, pests, and disease. The focus of restoration work is on removing the low-grade volume so that the remaining higher-grade material has room to grow and increases in vigor. Without markets for low-value trees that can wholly or partially offset the cost, the restoration work is cost-prohibitive. Because logs from small trees lack strong commercial value, the challenge lies in finding the highest price for a harvest’s lowest-value wood.

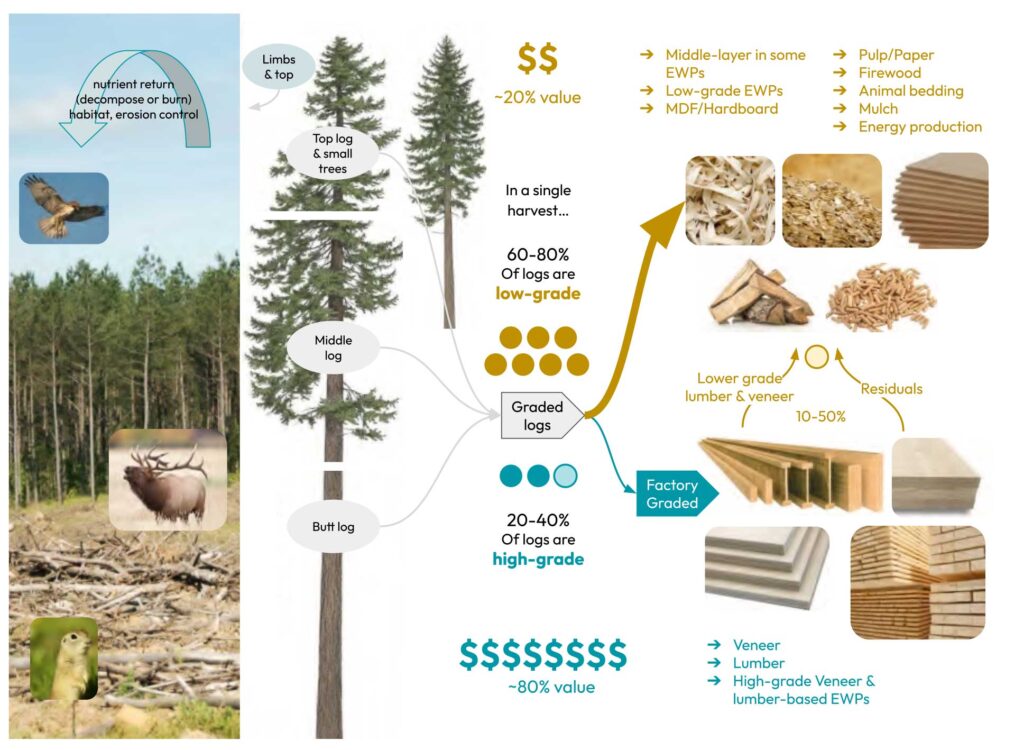

FIGURE 2: FOREST FIBER VOLUME-TO-VALUE FLOW

Source: Field Edge

VALUING AND GRADING FIBER:

IT’S NOT ALL TENDERLOIN

In a typical timber sale, about 20 percent to 40 percent of harvested trees are “high value,” and 10 percent to 50 percent of that high-value material will be regraded for lower-value uses or become residual waste. The highest-grade fiber that remains after processing represents about 80 percent of the value of the forest products market (see Figure 2). The other 20 percent of overall market value is coaxed from the 60 percent to 80 percent of harvest volume that is midgrade to low grade, where the margin between the harvesting, processing, and transport costs and the market value is either very limited, or the value is well below the costs.

The business end of a mature tree is the section of the log closest to the ground. The value of the fiber tends to go down as you move up the tree because there are more knots and bark and fewer clear, strong lengths. The crown and top stem are often left in the forest as “slash” to decompose and regenerate soil, sometimes accelerated by a controlled burn to reduce wildfire risk. Slash is also used for erosion control, moisture retention, wildlife habitat, and/or to buffer equipment movement through sensitive areas.

Companies can successfully position themselves in the lowest-value fiber streams by acquiring “harvest residuals” for the cost of delivery. But, as Matt King, vice president of sales and innovation at Heartwood Biomass, explains, making that work requires a robust local ecosystem of diverse facilities. Heartwood has no competition for the slash and low-grade “cull logs” they use as feedstock for firewood and poles because they do the kind of sorting that doesn’t pencil for loggers. King says, “It’s not all going to be tenderloins! We’re seeing that 80 percent of optional removal biomass that would normally be slash is stuff that we can take.” Even so, Heartwood’s residuals constitute up to 30 percent of the volume they receive, which they sell at a loss for a variety of other uses: hog fuel for biomass plants, “beauty bark” for landscaping, and chips for paper. The opportunities to upcycle waste streams are crucial for the business to work, and they need to be hyperlocal. As King puts it, “it can’t even leave the county.”

The built environment, on the other hand, is one of the highest-value places wood fiber can land. Veneer products, followed by lumber, require the strongest, straightest trees. Generally, peeler logs and sawlogs (for veneer and lumber, respectively) are sorted at the site of harvest. These logs then move to the manufacturing facility, where a second round of grading separates clear from anomalous material. In some cases, the lower-grade material can be used at the same facility by strategically placing it in middle layers of EWPs, or it can be transformed into an entirely new product. In other cases, the lowest-grade material is sold to secondary manufacturers who remanufacture it into products such as pallets and crates.

MAKING AND SELLING EWPS:

BALANCING ECOLOGY AND ECONOMY

Forest product companies of any size must decide how to purchase, sort, add value, distribute, and manage waste streams. Whether they’re harvesting from company-managed lands or purchasing logs on the open market, manufacturers can diversify by making multiple products that maximize their investment.

Oregon-based land manager and EWP manufacturer Roseburg Forest Products has a product portfolio that includes lumber and plywood. They also produce MDF made from sawdust from their mill’s by-products and LVL from specialty veneer grades sorted from their plywood mills. Any unused logs or residuals are used in their own facilities as energy or chipped for export. Another company operating primarily in the Pacific Northwest, RedBuilt, buys material to make and sell I-joists, LVL, and open-web joists as kit-of-parts building systems. “It’s really a suite of products that are delivering these projects,” says Jason Weber, vice president of sales. Although they prefer to produce with Douglas-fir, RedBuilt builds certainty and flexibility into their offerings by having Southern Yellow Pine (SYP) product certifications as well, in the event that local material is not available or is too expensive. “Inventing truss joists in the ’70s was kind of the precursor to the sustainability movement,” says Weber. Because there’s always a mix of quality in the fiber they get, making EWPs gives them the flexibility to make the best use of the resource as they receive it.

Large companies create efficiencies across multiple regions and markets. Manufacturing giant Georgia- Pacific operates in 30 US states, sourcing raw materials from a range of suppliers across the country. The largest parts of the trees they purchase are used for lumber and plywood, while residuals and thinnings are incorporated into EWPs like OSB or transformed into cellulose for paper, packaging, and pulp—all managed within the same company.

Even with their diverse portfolios, large companies must make improvements in utilization to stay nimble in rapidly changing markets. Boise Cascade recently developed a mass timber product using only the lowest-graded veneers, and the company’s innovation team is exploring the viability of biochar and insulation as higher-value alternatives for their waste material even though they currently use it to produce 70 percent of their manufacturing energy.

Small and large companies alike are highly dependent on strong local forest and wood product economies. As Canfor’s general manager of specialty products Kim Henze explains, “The density of the network matters.” Operating across Canada and the US, Canfor purchases stands wholesale from landowners, then harvests and sorts logs for use in making products. Their mills are focused on running volume, and EWP lines are focused on utilization and creating value. By volume, lumber production creates about 50 percent residuals: chips, shavings, and dust. Ideally, this material can be sold or delivered to companies that use it for pulp, energy, or animal bedding. “Everything is utilized, but the opportunity is to increase the value of products that are being created from residuals. There is a huge drive to extract more value from that 50 percent.” Like King, she stresses that if there aren’t value-added producers nearby, transport will be too costly, and that value cannot be captured. More interconnection opens greater opportunities for utilization.3

Katie Cava, who oversees sustainability certification of forests and mills at Weyerhaeuser, agrees with Henze. She says that, right now, markets for thinnings are mostly pulp or pellets, but they’d like to see higher-value markets. Products like the company’s proprietary TimberStrand are one way to capture value from smaller trees, in turn supporting the landowners with whom Weyerhaeuser works. Cava notes, “Strong EWP markets help our smaller-scale landowners make the decision [to thin]. It’s really hard for someone who owns just 40 acres to [spend money to] thin their forests if they don’t have anywhere to sell that wood.”

Vertically integrated companies that manage forests and manufacture diverse products have greater fiber utilization flexibility than more specialized ones, but specializing has its advantages too. The majority of the industry in North America is dispersed, with business models relying on well-established systems. Sterling, the highest-volume CLT manufacturer in the US, has focused on commodity feedstock since the company was founded 75 years ago. Michaela Harms, senior director of mass timber, explains how Sterling built its equipment line to maximize the existing supply chain by using standard dimensions and processes. This allows the company to purchase raw materials that, along the production line, require the least amount of modification, thereby reducing waste (and cost). Harms focuses her work on efficiency at the project level because most of the waste from these products occurs during design and construction.

BEYOND 100 PERCENT

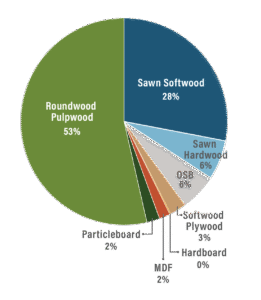

EWPs made from high-value lumber or veneers are marvels of engineering and achieve incredible things in the built environment, but those made from chips and strands also have an important role in a building’s sustainable procurement story. OSB was invented in the late ’70s as a way to use surplus aspen in the Lake States region. It now represents almost 6 percent of all wood fiber consumption in the US (see Figure 3),4 a market double that of plywood that equates to about $6 billion in annual sales. The same data shows that 53 percent of wood fiber consumption is pulpwood, which makes me wonder, what will the next breakout product be, and how can we use more of the suite of products already at our fingertips?

Which turns our attention toward construction, which discards 15 percent of the wood products it purchases—before they are even put to use;5 8.3 percent of all landfilled municipal solid waste is wood.6 With this in mind, designers could better optimize our designs to minimize postmanufacturing waste. We could also look for opportunities to use lower-grade EWPs, knowing that this is the longest-lasting place in the market for this carbon to be stored. During our conversation, forester Fast noted that only 16 percent of a tree can be used for clear lumber as specified by architects. He implores architects to rethink their finish specifications to reduce pressure on clear-grain wood. To achieve a full circular economy, end users have work to do.

FIGURE 3: FOREST AND WOOD PRODUCTS BY VOLUME

2023

Source: USDA

THE CASE FOR INDUSTRIAL DIVERSITY

The expanding suite of wood products—and the facilities that produce and support them—is an intricate ecosystem that needs diverse markets to thrive. When any part of that system goes away, as in the precipitous disappearance of pulp mills over the past few years,7 the impacts ripple immediately into other wood products businesses and forest thinning projects. Mass timber is relatively new on the scene, and it’s a fantastic example of how innovations in the supply chain continue to develop,8 with new products and utilization improvements that inspire designers and foresters alike. The best and highest value of a harvested stand of trees, however, is rarely going to be captured at one facility. We miss a lot of the story if we just look at one product type at a time.

In the end, I did change my toilet paper subscription (you were dying to know, right?), and I’ll continue to seek more durable pulpwood products. As the highest-value market outlet for wood products, the construction industry is in a truly remarkable position to help improve forest health outcomes. If using paper products improves forest health while helping bring down the cost of lumber, I’m sure that innovators in the building industry can find many other ways to use this fiber in a much more durable way.

REVOLUTIONIZING NAIL LAMINATED TIMBER (NLT) WITH SILVASPAN

STANDING OUT IN THE MASS TIMBER industry is no small feat. But reinventing age-old technology? That’s an even greater challenge. SilvaSpan has successfully embraced both. Drawing from over a decade of experience, the Lowell, Ontario, company has redefined Nail-Laminated Timber (NLT), bringing this heritage construction material back to the mainstream. With a focus on precision and beauty, SilvaSpan has modernized NLT, using off-site construction to create panels that combine stunning aesthetics with superior performance and low cost. According to Kevin McElhone, director, SilvaSpan is a small company that’s achieving big things. The mission is clear: to revive the unique NLT heritage with big updates to product performance and make it cost-effective for today’s mass timber market.

THE CURVED CEILINGS IN THE BRIGHTWATER BUILDING IN PORT CREDIT, ONTARIO, SHOWCASE THE DESIGN FLEXIBILITY OFFERED BY NLT PANELS

Source: SilvaSpan

AUTOMATED NLT MANUFACTURING

NLT has been used to construct our cities for over a century. Traditionally, NLT was assembled on-site because lumber was abundant and labor was inexpensive. In today’s mass timber world, however, efficient off-site construction, with strict quality controls and precision manufacturing, are all crucial ingredients for success.

SilvaSpan has revolutionized this process by automating the manufacturing of NLT panels. The company developed an innovative 4-step process to ensure consistent quality:

-

- Finger-jointing standard dimensional lumber 2×4 to 2×12 into lengths up to 60 feet

- Planing the finger-jointed lumber on all sides to remove any blemishes and achieve uniform thickness

- Coating each lamina with a clear sealant for moisture control

- Using custom-made, patented automated press equipment to nail the boards together into panels varying from 4 inches to 12 inches thick by 8 feet to 12 feet wide and up to 60 feet long

THE COST ADVANTAGES OF NLT

SilvaSpan has been in operation for almost 2 years and has already secured a steady stream of orders. According to McElhone, the success of SilvaSpan’s NLT lies in its distinct beauty, low cost, excellent product performance, and optimum wood use.Regarding NLT’s aesthetic appeal, architects frequently praise the vertical grain orientation, which creates a sleek, linear look that stands out compared with CLT panels.There’s also SilvaSpan’s low start-up cost. Compared with Cross-Laminated Timber (CLT) plants, SilvaSpan’s manufacturing equipment is significantly less expensive. SilvaSpan designed and built the automated nail press to provide precision control in the panel manufacturing.

Another advantage is enhanced product performance through patented design. SilvaSpan’s NLT panels feature small gaps between the laminas. This patented manufacturing innovation allows the panels to accommodate the natural shrinking and swelling of wood due to changes in moisture, ensuring stable panel dimensions over time.

THE CEILINGS IN THE ONE YOUNG MASS TIMBER BUILDING IN KITCHENER, ONTARIO, FEATURE NLT PANELS THAT HIGHLIGHT THE STRENGTH, SUSTAINABILITY, AND NATURAL BEAUTY OF ENGINEERED WOOD SOLUTIONS

Source: SilvaSpan

Finally, NLT’s strength efficiency offers cost savings. Unlike CLT panels, which rely primarily on their longitudinal lamellas for strength, NLT panel strength comes from its entire profile, as all the wood fibers are oriented in the same direction. This results in a higher strength-to-volume ratio, meaning less wood is needed to achieve the same performance, translating into lower costs for builders.

A BRIGHT FUTURE FOR NLT

With their visual appeal, excellent performance, and cost advantages, NLT panels are well positioned to gain traction in the mass timber construction industry. However, McElhone acknowledges that awareness is a hurdle. Many architects, engineers, and developers are still unfamiliar with NLT and SilvaSpan. By highlighting its benefits, McElhone hopes to bring NLT into the spotlight and secure its place in the future of sustainable construction.

1 Dovetail Partners Inc., “Utilization of Harvested Wood by the North American Forest Products Industry,” https://www.dovetailinc.org/upload/tmp/1580241837.pdf.

2 Ethan Tapper, “What Is ‘Low-Grade’ Wood? Why Markets for Low-Grade Wood Are Essential to Healthy Forests,” https://www.youtube.com/watch?v=x8X_mBf_nII.

3 See Lech Muszyński’s chapter 10 in this report for more on manufacturing and geographic distances.

4 United Nations Economic Commission for Europe, “United States Forest Products Annual Market Review and Prospects: Country Market Report, 2021-2025,” https://unece.org/sites/default/files/2023-11/US_FPMAR_2023-2024_Nov3.pdf.

7 Forisk Consulting, “Pulpmill Slowdown: What Is Going On?” https://forisk.com/blog/2023/05/26/pulpmill-slowdown-whatis-going-on/.

8 See ‘Eat the Problem’ by Lech Muszynski in the 2023 International Mass Timber Report.

Download PDF

View the Agenda

View the Agenda

Book a Building Tour

Book a Building Tour

Book Your Exhibit Space

Book Your Exhibit Space

Explore the Exhibit Hall

Explore the Exhibit Hall

Become a Sponsor

Become a Sponsor

View Sponsors & Partners

View Sponsors & Partners

Reserve Hotel Rooms

Reserve Hotel Rooms

Discounted Plane Tickets

Discounted Plane Tickets

Read Case Studies

Read Case Studies

Download Past Reports

Download Past Reports